Stripe, a US-based payments giant, is venturing its business into Africa by obtaining Lagos-based payments firm Paystack in an arrangement supposedly worth more than $200 million.

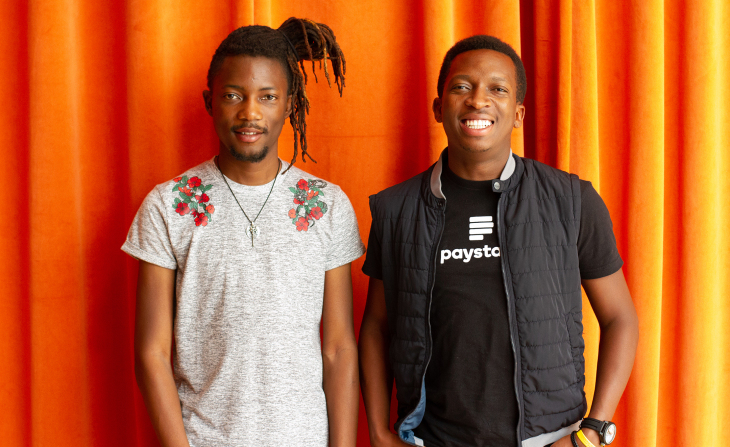

Established in 2015 by Shola Akinlade and Ezra Olubi, Paystack tackled online payments in Nigeria.

Via seamlessly interfacing all multi-channel payment alternatives with traders nationwide, it empowered them to acknowledge payments from around the globe using a credit card, debit card, and direct bank transfer on web and mobile.

Like Stripe, Paystack gives APIs that let merchants, with merely a couple of lines of code, construct online payment features

For some in the Nigerian tech ecosystem, this acquisition was no surprise. It was merely an issue of time before this occurred, and the reason is not far fetched.

Their ability to provide a quick way to integrate payments services into an online or offline transaction through an API. Made people refer to them in the past as “the Stripe of Africa.”

This got the one-year-old startup into a US-based seed-stage accelerator agent, Y Combinator, where it got $120k in financing and access to worldwide investors.

That same year, it raised a seed financing of $1.3 million from Tencent, Comcast Ventures, Singularity Investments, Michael Seibel, Justin Kan, Jason Njoku’s SPARK.ng, Olumide Soyombo among different investors.

In any case, in 2018, Paystack put everybody on notice as it brought $8 million up in Series A financing. With cooperation from a worldwide payment organization, Visa, a US-based accelerator agent, Y Combinator, and Tencent, Stripe, a comparable payment organization situated in the US, led the round.

Three years in the wake of launching, this carried the organization’s absolute financing to somewhat over $10 million. Furthermore, from that point forward, the organization hasn’t raised a follow up round.

According to techcrunch.com, Paystack before the deal had about 60,000 customers, including small businesses, larger corporates, fintech, educational institutions, and online betting companies. The plan will be for it to continue operating independently, the companies said.

“There is an enormous opportunity,” said Patrick Collison, Stripe’s co-founder, and CEO, in an interview with TechCrunch. “In absolute numbers, Africa may be smaller right now than other regions, but online commerce will grow about 30% every year. And even with wider global declines, online shoppers are growing twice as fast. Stripe thinks on a longer time horizon than others because we are an infrastructure company. We are thinking of what the world will look like in 2040-2050.”

The deal’s terms are not being unveiled; however, sources near it confirm that it’s over $200 million. That makes this the most excellent startup acquisition to date to emerge from Nigeria, as well as Stripe’s most outstanding procurement to date anywhere. (Sendwave, obtained by WorldRemit in a $500 million deal in August, is based in Kenya.)